Table of Content

Brandon is managing partner at Hall CPA PLLC (''The Real Estate CPA''). Brandon leads a team of 25 tax and accounting professionals who service the firm's 700+ real estate investor clients. Brandon has gained a significant amount of tax experience over the years and has made it his mission to educate as many real estate investors as possible on tax opportunities available to them. Brandon's personal real estate portfolio consists of 12 properties / 24 units and Brandon has stakes in rental syndications across the U.S. The good news is that these loan fees are summarized for you on Page 2, Line D “Total Loan Costs” of your standard closing disclosure.

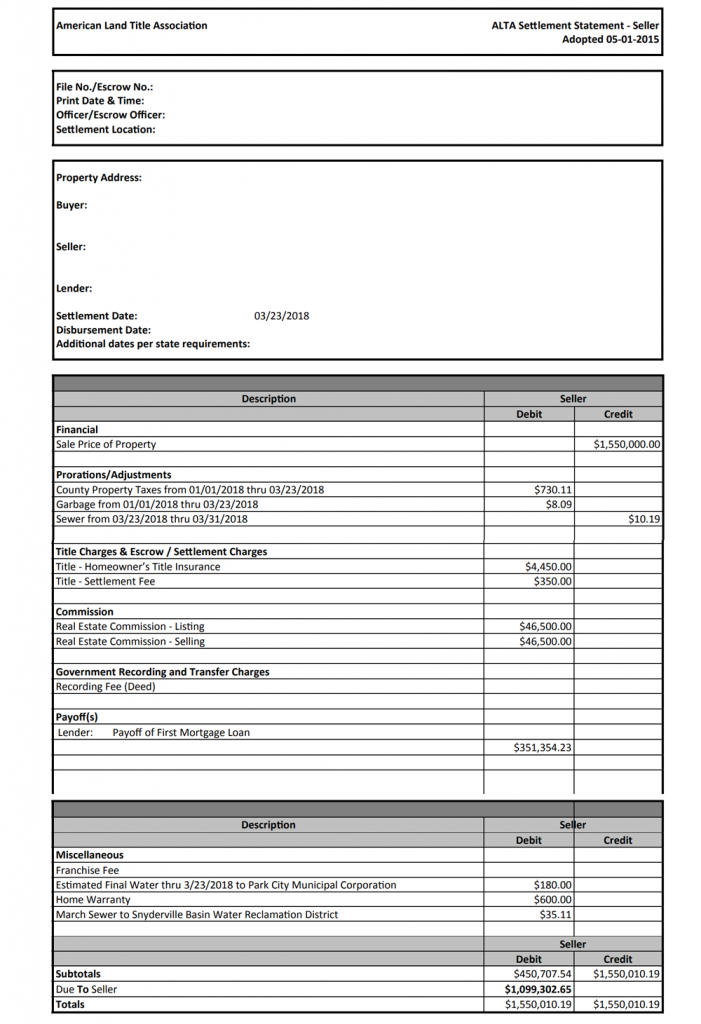

Are the one-time fees you pay when you obtain a mortgage loan. Typical closing costs run anywhere from 2% to 5% of your loan amount. For example,on a $250,000 loan, you’ll pay between $5,000 and $12,500 in closing costs. You can add these closing fees to the cost basis of your home when you sell it. This can help reduce any capital gains tax you might have to pay on your home.

Which closing costs can I deduct on my taxes?

In general, costs that can be considered taxes or interest are deductible. But, as you’ll learn below, the IRS classifies some expenses as interest that the average person doesn’t. You may be able to deduct more closing costs than you think.

If you didn't get a new MCC, you may want to contact the state or local housing finance agency that issued your original MCC for information about whether you can get a reissued MCC. The seller must give you this number and you must give the seller your SSN. Form W-9, Request for Taxpayer Identification Number and Certification, can be used for this purpose. Failure to meet either of these requirements may result in a $50 penalty for each failure. If you refinance the mortgage with the same lender, you can't deduct any remaining points for the year. Instead, deduct them over the term of the new loan.

Mortgage Interest

The amount of the refund will usually be shown on the mortgage interest statement you receive from your mortgage lender. If the total amount of all mortgages is more than the fair market value of the home, see Pub. Your deduction for home mortgage interest is subject to a number of limits.

Nondeductible payments, Nondeductible payments., Items not added to basis and not deductible. LITCs represent individuals whose income is below a certain level and need to resolve tax problems with the IRS, such as audits, appeals, and tax collection disputes. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee for eligible taxpayers. To find an LITC near you, go to TaxpayerAdvocate.IRS.gov/about-us/Low-Income-Taxpayer-Clinics-LITC or see IRS Pub.

Are closing costs tax deductible Turbotax?

You could save a significant amount of money by educating yourself before the tax return deadline. Texas laws cap lender fees to 2% of a loan's principal. Amplify Credit Union keeps home equity loan closing costs low with a flat $325 closing fee— no matter the loan amount.

Tax season is the least favorite time of year for many Americans — and not just because they end up owing money to the government. Bank products and services are offered by Pathward, N.A. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas.

If you pay off your home mortgage early, you may have to pay a penalty. You can deduct that penalty as home mortgage interest, provided the penalty isn't for a specific service performed or cost incurred in connection with your mortgage loan. Usually, you can deduct the entire part of your payment that is for mortgage interest if you itemize your deductions on Schedule A . See Limits on home mortgage interest next for more information. You can deduct $244 on your return for the year if you itemize your deductions. You are considered to have paid this amount and can deduct it on your return even if, under the contract, you didn’t have to reimburse the seller.

You must also add to your basis state and local assessments for improvements such as streets and sidewalks if they increase the value of the property. These assessments are discussed earlier under State and Local Real Estate Taxes. If you use the donor's adjusted basis to figure a gain and it results in a loss, then you must use the FMV to refigure the loss. However, if using the FMV results in a gain, then you have neither a gain nor a loss. If someone gave you your home and the donor's adjusted basis, when it was given to you, was more than the FMV, your basis at the time of receipt is the same as the donor's adjusted basis.

To be deductible, the interest you pay must be on a loan secured by your main home or a second home, regardless of how the loan is labeled. The loan can be a first or second mortgage, a home improvement loan, a home equity loan, or a refinanced mortgage. An assessment for a local benefit may be listed as an item in your real estate tax bill.

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. The points were calculated based on the loan’s principal amount. The mortgage must have been used to buy or build your primary home.

No comments:

Post a Comment